Strengthened funding.

Record liquidity.

Industry recognition.

Supported by increased lending volumes, successful product expansion, and strengthened institutional funding, interest income grew to €78.2 million during the first 9 months of 2025. That is an increase of 46.8% (€53.3 million) from the first 9 months of 2024.

Net profit was + 135% higher in first 9 months of 2025 (€11.6 million) vs first 9 months of 2024 (€5.0 million), substantially outpacing revenue growth and reflecting the strategic focus on higher-quality customers, and enhanced portfolio performance.

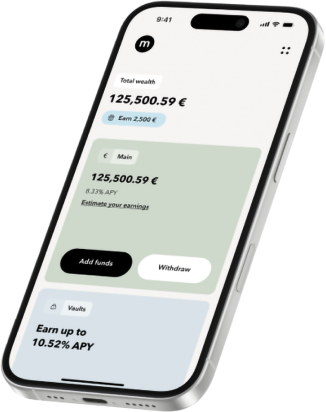

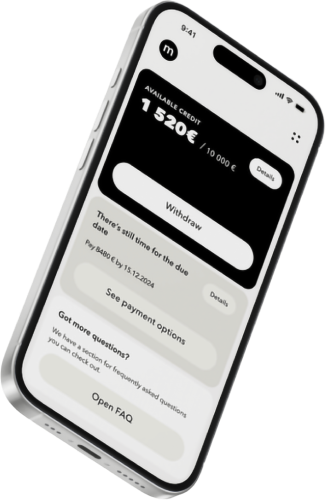

Loans to customers reached €438.4 million at the end of Q3 2025, representing 35.3% year-over-year growth (€ 324.1 million as of Q3 2024) driven by higher lending volumes and deeper market penetration.

Portfolio expansion was supported by the successful rollout of enhanced credit products, including larger loan amounts and extended tenures in Finland, Poland, and Estonia.

Loan impairment charges amounted to €9.2 million during first 9 months of 2025 vs €8.8 million during the first 9 months of 2024.

Interest expense share from interest income decreased 3.6 percentage points to 46.9% (first 9 months of 2025) vs 50.5% (first 9 months of 2024) as a result of the reduced average cost of capital as well as improved profitability of issued loans.

Operating expenses amounted to €15.2 million (first 9 months of 2025) vs €8.3 million (first 9 months of 2024), with higher marketing and loan issuance related costs, driven by the growth of the lending volumes.

Wages and salaries increased to €4.1 million (first 9 months of 2025) vs €3.0 million (first 9 months of 2024), supporting team expansion across product, engineering, data analytics, and regional operations to sustain growth momentum and strengthen operational capabilities.

These initiatives support the company's focus on higher-quality customers, portfolio diversification, and long-term revenue growth.